Learning to Budget

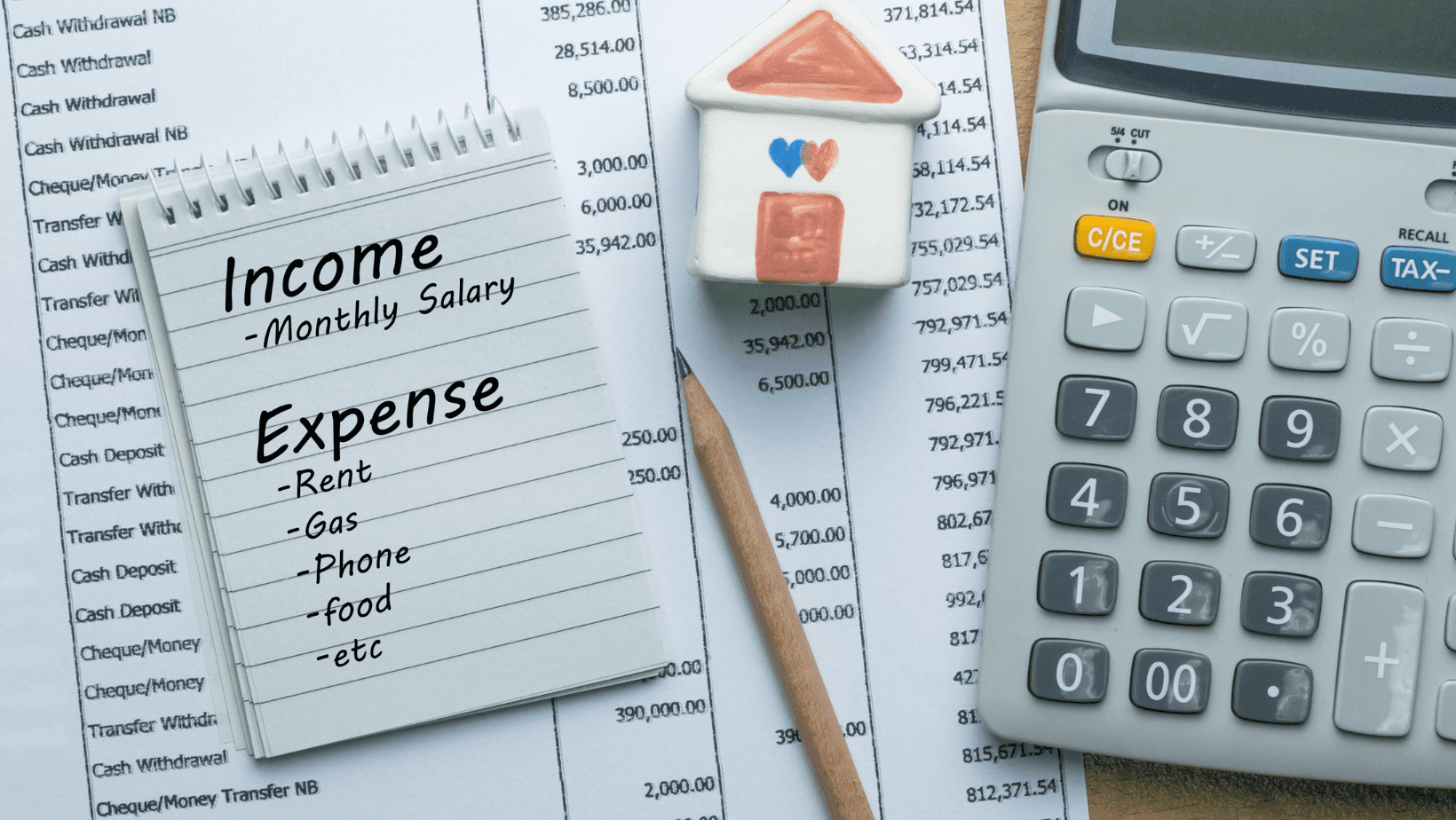

A budget is a plan for how you’ll spend your money. To create one, you divide your income (the money you get) into your expenses (the things you buy). Income Your income probably falls into one of these categories right now: You earn a regular allowance—A steady flow of money makes creating a budget easy.