Lower Risk. More Interest.

A Certificate of Deposit, or CD, may be for you if you prefer a low-risk investment with a fixed interest rate. First Southern offers a wide variety of CD terms ranging from six months to six years, with multiple interest payment options.

- Interest paid monthly, quarterly, semi-annually or at maturity and can be paid by deposit into a First Southern account

- Convenient, automatic renewal

- Penalty may apply for early withdrawal

- A $500 deposit will open a CD

What Is A Certificate Of Deposit?

A certificate of deposit (CD) allows you to earn high-interest rates by agreeing to leave money with First Southern for a specified amount of time.

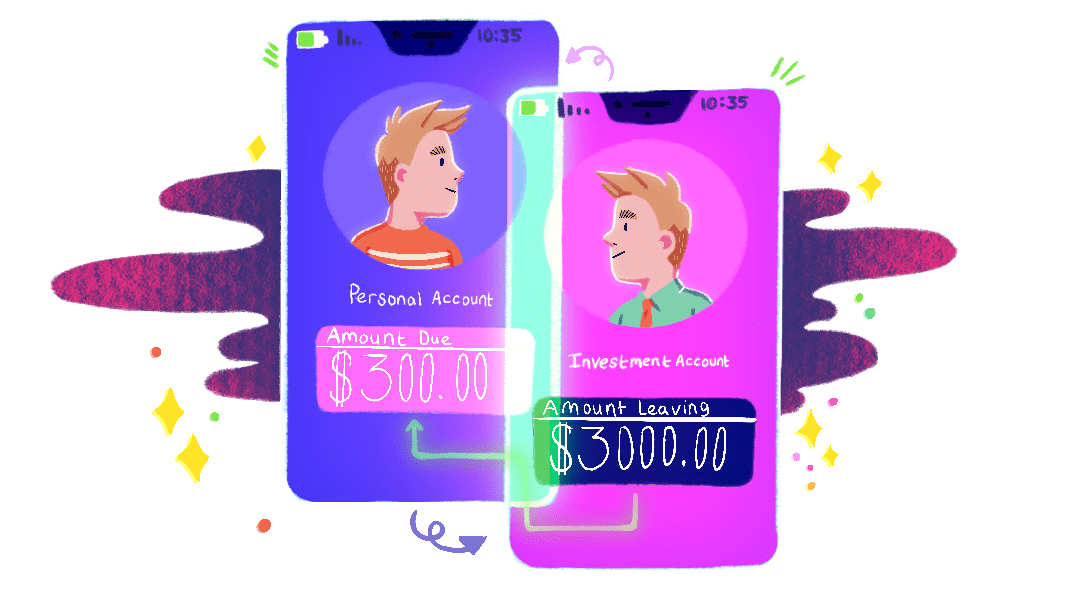

The length of a CD can vary, but anywhere between six months and five years is common. The minimum deposit for a First Southern CD is $500. In investment terms, the money you put in is known as your principal. The length of the CD is its term, and the time it matures, or ends, is its date of maturity.

Choosing CDs

The interest rate and annual percentage yield (described below) determine how much you earn on a CD. Generally, a longer-term gets a higher rate. Rates can also vary a lot from year to year.

What Happens at Maturity

When a CD matures, you generally have a time limit to decide what to do with the money. If you wait too long, a bank usually rolls over or reinvests, your money in another CD for the same term at the current rate.

Compounding is Key

What you actually earn on your CD is the yield— specifically the annual percentage yield (APY). The yield depends on whether the interest is simple or compound, and how often it’s compounded.

Simple interest is paid only on the principal you initially invested in. Compound interest adds in the money that has been earned. To compare the two, try entering different amounts into the tool below.

Disclaimer

While First Southern National Bank hopes you find this content useful, it is only intended to serve as a starting point. Your next step is to speak with a qualified, licensed professional who can provide advice tailored to your individual circumstances. Nothing in this article, nor in any associated resources, should be construed as financial or legal advice. Furthermore, while we have made good faith efforts to ensure that the information presented was correct as of the date the content was prepared, we are unable to guarantee that it remains accurate today.

Neither Banzai nor its sponsoring partners make any warranties or representations as to the accuracy, applicability, completeness, or suitability for any particular purpose of the information contained herein. Banzai and its sponsoring partners expressly disclaim any liability arising from the use or misuse of these materials and, by visiting this site, you agree to release Banzai and its sponsoring partners from any such liability. Do not rely upon the information provided in this content when making decisions regarding financial or legal matters without first consulting with a qualified, licensed professional.

BELIEF

When First Southern National Bank says, “We Believe In You,” it means we also believe certain things about you. We believe that you want to live a life of margin, where you can balance spending, saving, and giving. We believe that you want to make wise financial decisions to enable that kind of living.

Because we believe in you, we are here for you every step of the way.