Making Your Income Work For You

Individual Retirement Accounts, IRAs, are tax-deferred interest-bearing accounts available to anyone with earned income to set aside for retirement. You can open an IRA with as little as $100. Certain restrictions and contribution limits apply. Please consult a tax advisor for details.

Traditional IRA

- Contributions may be tax deductible (consult a tax advisor for details)

- Spousal contributions are permitted

- One or more beneficiaries may be designated

- Penalty may apply for early withdrawal

Roth IRA

- Earns interest that may be tax-free when balance is maintained for at least five years

- Withdrawals may be made tax-free upon disability, death, reaching the age of 59½ or for first home purchase

- Funds can be deposited at any age and are not subject to minimum withdrawal or distribution requirements

- Spousal contributions are permitted

- One or more beneficiaries may be designated

- Penalty may apply for early withdrawal

What Is An Individual Retirement Account?

Individual retirement accounts (IRAs) are tax-deferred, personal retirement plans. You must have earned income to contribute, and you can put money into an IRA whether or not you participate in an employer’s retirement plan.

There are two types: the traditional IRAs, to which contributions may be deductible or nondeductible, and the Roth IRA.

- All traditional IRAs are tax deferred. This means you owe no tax on your earnings until you withdraw. If you qualify, you may be able to deduct your contribution on your federal income tax return, deferring tax on that amount as well.

- Roth IRAs are not tax-deferred, which means you owe taxes when you contribute the money to the account. Withdrawals are tax-free if your account has been open at least five years and you’re at least 59 and a half.

Whether you can deduct your contribution or not, you may face a potential 10% tax penalty on top of any tax that’s due on deferred amounts you withdraw before you turn 59 and a half. You must take your first required minimum distribution for the year in which you turn age 72 (70 ½ if you reach 70 ½ before January 1, 2020). However, the first payment can be delayed until April 1 of 2020 if you turn 70½ in 2019. There’s no tax penalty if you take at least the minimum, but all tax-deferred amounts you withdraw are taxed at the same rate as your ordinary income. Contributions to a Roth are never deductible, but you can continue to contribute as long as you have earned income. And you’re never required to take RMDs.

Contribution Limits

The only requirement for opening an IRA is having earned income—money you get for work you do. Your total annual contribution is limited to $6,000 for 2020, whether you put it all in one account or divide it between a traditional IRA and a Roth. If you’re 50 or older, you can add an annual catch-up contribution of $1,000. You’re eligible whether you’ve contributed to an IRA in the past or not.

Any amount you earn qualifies, and you can contribute as much as you want, up to the annual cap. But you can’t contribute more than you earn. For example, if you earn $1,800 in a year, that’s how much you can put in. And whether you earn $5,500 or $350,000, the top limit is the same.

Spousal Accounts

If your husband or wife doesn’t work, but you do, you can contribute up to $6,000 for 2020 to a separate spousal account in your spouse’s name. The advantage for the nonworking partner is being able to build an individual retirement fund that he or she owns and controls.

Which IRA for You?

If you qualify to contribute to a Roth IRA, based on your modified adjusted gross income (MAGI), or to deduct your contribution to a traditional IRA, you’ll probably want to choose between them.

The income limits are stricter for deducting your contribution to a traditional IRA than for contributing to a Roth IRA.

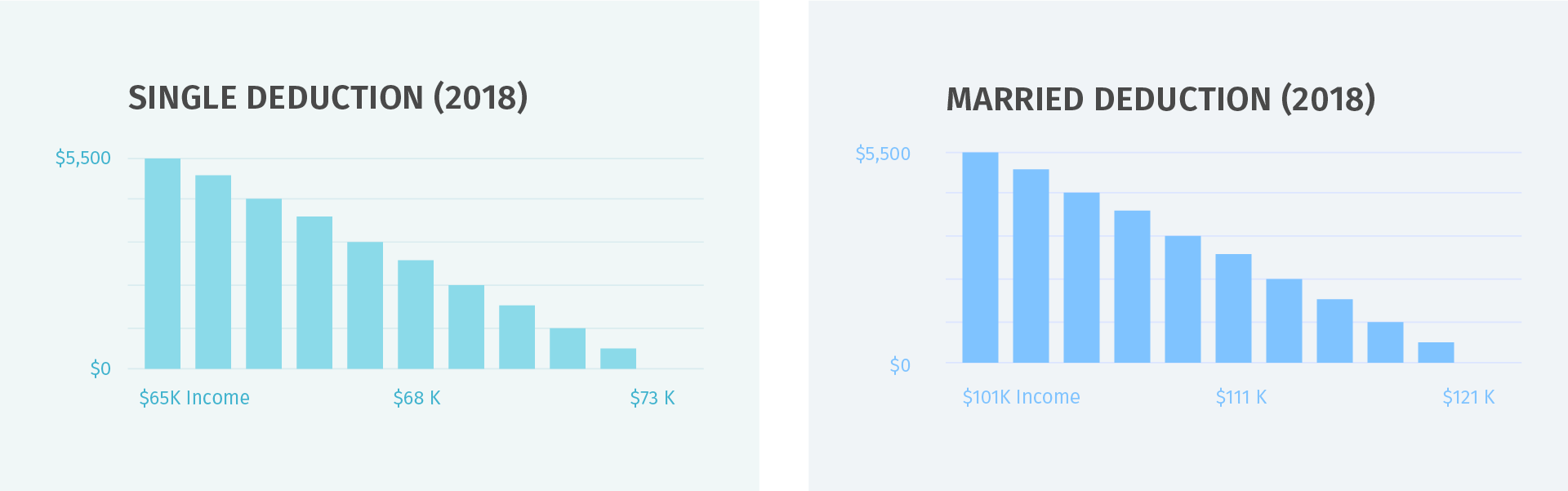

In 2020, for example, you can deduct all of your IRA contributions if you’re single, and you either don’t have a retirement plan where you work or your MAGI is less than $63,000. You can deduct a gradually decreasing portion of your contribution as your income gets closer to $73,000 and nothing if it’s above $73,000. You can always deduct the full amount of your contribution if you’re not eligible for a retirement plan at your job or your employer doesn’t offer one.

You’re eligible for a full Roth contribution in 2020 if you’re single and your AGI is less than $120,000. With an AGI between that amount and $135,000, you can put a gradually declining portion of your contribution into a Roth and the balance into a traditional IRA if you wish.

For a married couple filing a joint return, the income limits for a deductible traditional IRA begin at $104,000 and are phased out at $124,000 for 2020. Either of you can deduct your contribution if you have no retirement plan of your own at work or aren’t eligible. But if your spouse has a plan, the amount you can deduct is reduced gradually if your joint modified adjusted gross income is over $196,000 in 2020, and eliminated if it’s over $206,000. Each of you qualifies to contribute the full $6,000 to a Roth IRA if your joint MAGI is $196,000 or less in 2020 and smaller amounts until it reaches $206,000 when your eligibility is phased out.

It’s Your Account

It’s easy to open an IRA. All you do is fill out a relatively simple application provided by the bank, mutual fund company, brokerage firm, or other financial institution you choose to be the custodian of your account. First Southern would love the opportunity to serve you in one of our branches.

Because IRAs are self-directed, which means you decide how to invest the money, you’re responsible for following the rules that govern the accounts. Basically, that means putting in only the amount you’re entitled to each year and making approved investments. You must also report your annual contribution to a traditional IRA to the IRS, on Form 1040 or 1040A if it’s deductible and on Form 8606 if it’s not.

You can invest your IRA money almost any way you like that’s available through your custodian, from putting it in sedate savings accounts to buying volatile options on futures. The things you can’t choose are fine art, gems, non-US coins, and collectibles. You can buy and sell investments within your IRA and reinvest the money whenever you please without worrying about paying tax on any gains. But you may pay sales charges and other fees on those transactions.

When to Contribute

You have until April 15—the day tax returns are due—to open an IRA and make the deposit for the previous tax year. If April 15 falls on a Saturday or Sunday, your deposit is due by Monday, April 16 or 17, or sometimes as late as April 18.

You can put money into your IRA in a lump sum, or spread your contribution out over up to 15 months. You may put in the whole amount the first day you can, January 1 of the tax year you’re making the contribution for. Or, if you’re like most people, you’re more apt to make the deposit on the last possible day, which is April 15 for the previous tax year.

The most practical solution may be weekly or monthly contributions, perhaps as direct debits or electronic transfers from your checking account. There are no guarantees when you invest this way, any more than there are when you invest a lump sum. You could lose money, especially in the short term. But if your investments do well, adding to them regularly can give your account value a real boost. And the longer money is invested, the more it has the potential to grow.

Disclaimer

While First Southern National Bank hopes you find this content useful, it is only intended to serve as a starting point. Your next step is to speak with a qualified, licensed professional who can provide advice tailored to your individual circumstances. Nothing in this article, nor in any associated resources, should be construed as financial or legal advice. Furthermore, while we have made good faith efforts to ensure that the information presented was correct as of the date the content was prepared, we are unable to guarantee that it remains accurate today.

Neither Banzai nor its sponsoring partners make any warranties or representations as to the accuracy, applicability, completeness, or suitability for any particular purpose of the information contained herein. Banzai and its sponsoring partners expressly disclaim any liability arising from the use or misuse of these materials and, by visiting this site, you agree to release Banzai and its sponsoring partners from any such liability. Do not rely upon the information provided in this content when making decisions regarding financial or legal matters without first consulting with a qualified, licensed professional.

BELIEF

When First Southern National Bank says, “We Believe In You,” it means we also believe certain things about you. We believe that you want to live a life of margin, where you can balance spending, saving, and giving. We believe that you want to make wise financial decisions to enable that kind of living.

Because we believe in you, we are here for you every step of the way.