There is an oft-repeated urban legend that when asked to name the greatest invention in human history, Albert Einstein simply replied, “compound interest.” Depending on the source, perhaps he called compound interest the 8th wonder of the world. What he actually said does not matter. We all know that compounding is a powerful thing. As a banker, I have an especially strong appreciation for compound interest. Banking is a great business because interest never sleeps.

I want to submit that almost all of the benefits in every area of life are derived from the power of compounding. The important things in life are not urgent, and they are easy to put off. They will wait. If we neglect them today, we can attend to them tomorrow with no big consequences. But, if we neglect them for a long time, the consequences can be devastating. The truly important things accumulate value over time.

For example, we all want to be healthy. We want to look and feel our best, but it will not happen overnight. Good health results from habits—months and years of eating nutritious foods, exercising regularly and maintaining a healthy lifestyle. The quick fixes—the fad diets—never last. We end up going up and down like a yo-yo.

Or take knowledge. Unless one is extraordinarily gifted, mastering a skill or profession requires thousands of hours of consistent study and practice. Yet many of us move from one college major, job, or career to the next one. Whatever knowledge, proficiency, or relational capital we might have attained is squandered and lost.

I have realized that nowhere is the principle of compounding more important than in our relationships, especially with those closest to us. This applies equally to our professional and personal lives. However, quality time spent with important people is seldom urgent. We probably do not write it on our to-do lists. We can put it off for hours or days or weeks. Ah, but we kid ourselves if we think that just because it is not urgent, it does not matter. It matters as much or more than anything else.

The Power of Compounding Relationships

Thirty-eight years ago, when I decided to leave Hilton Head Island, where I had lived for five years selling real estate, my pastor and good friend Chuck gave me some advice that I have never forgotten. He told me, “Doug, remember – who you are with is more important than what you do.” I was 27 years old and had no idea what I would do for a career, but I never forgot his advice. So, when my good friend, Jess Correll, called me in February of 1985 and asked if I wanted to work with him, I never hesitated. I dropped out of MBA school, moved to a small town near the Tennessee line, and started my career in banking. You see, I knew Jess. We had been friends for 11 years. I knew his ability. I knew his passion. I knew he was a rainmaker. But more importantly, I knew the depth of his character. I knew his strengths and weaknesses, and I knew my own. I believed that we would do great things together. That was a watershed moment for me and one of the wisest decisions I would ever make in my life.

The past 36 years have been an incredible ride. We started with a couple of little country banks. They were barely profitable, and morale was low. But it was a great place to learn. We didn’t know much about banking, but the banks we acquired were in bad shape, and we could hardly make them worse. Over time, Jess assembled an inner-circle team of smart, energetic, likable, and high-character folks. Providentially, we had some fabulous mentors and directors who were willing to put their personal credibility on the line to come alongside us. And we had enough sense to listen to them.

We began to learn and grow. We acquired more local bank charters and opened a few de novo banks. With each acquisition came more talented people. We didn’t wait for customers to walk in the door – we went out looking for them. Jess’s father was one of our mentors, and he said, “Boys, business is easy. Just go out and make friends, and ask them to do business with you.” And that’s what we did.

In 1988, one of our mentors invited us to go with him to Chicago to participate in an FSLIC auction of commercial real estate loans out of a failed Savings and Loan in Tennessee. While there, we bought our first pool of discounted loans. So, when the RTC started selling loans in the late Fall of 1990, we already knew the game and hit the ground running. The next few years were wild. We flew all over the Eastern US buying discounted, often distressed, commercial real estate loans. It was hectic, nerve-wracking, fun and highly profitable.

And we did it all with various trusted strategic partners we met along the way. Our mentors had instilled in us an abundance mentality. We learned that “deals are like buses; there’s always another one coming.” The more trusted partners we cultivated, the bigger the deal flow. Plus, we made some lifelong friends.

Because of the power of compounding relationships, we have an incredible team of talented people. We have directors that give us wise counsel, and we have long-term partners of high character and proven expertise. When we find a great team member or a great partner or a great customer, we do our best to add value to that relationship and keep them for life—because when you have trust and respect and you like each other, everything gets easier and more enjoyable.

All the unnecessary friction goes away.

The Long Game in Business

Still, compounding only does its magic over extended periods of time. We live in a world of fast food, entertainment on demand and instant gratification. Everybody seems to have a short-term focus. Businesses obsess over last quarter’s earnings. But not us. That’s not the game we are playing. We are playing a long-term game.

It seems like every few days, as we meet new people, they want to hear about our story. When we tell folks that Jess, our partner Jimmy, and I have been together for 36 years, they are amazed. That’s unusual.

Here are some of the ways we play the “Long Game”:

We strive to:

1. Make the next right decision. We hold each other accountable to love others as we love ourselves and act in harmony with our values and principles, like forming a charitable foundation and tithing our pretax net income.

2. Focus on the process. We say, “Focus on the process, and the results will follow.”

3. Remember that the relationship is more important than the deal. We have learned that relationships yield huge returns over time.

4. Diligently guard our integrity and reputation. Warren Buffet famously said, “It takes 20 years to gain a great reputation and 5 minutes to lose it. If you think about that, you will do things differently.”

5. Enable and encourage our team members to own stock in our company and empower them to think like owners. We give them regular opportunities to acquire stock at book value.

6. Grow our leaders from within. We continually invest in our most valuable asset—our team members.

7. Plan for the future. We give a lot of time and thought to succession planning and identifying and mentoring the next generation of leaders.

8. Stay green and growing. We don’t allow a little success to go to our head, and we continually look for ways to improve.

9. Be lifelong learners. We read and share articles and podcasts with each other every day. We strive to go to bed each night a little bit smarter.

10. Do not chase fads or follow the crowd. We know that the economy goes in cycles—booms and busts. We have always done extremely well during the busts. So, we remain disciplined and patient.

11. Play to our strengths. We have proven to do a few things exceptionally well. We try to keep on doing those things.

12. Learn from mistakes, but do not dwell on them for too long. We live by the adage often attributed to Winston Churchill: “Success is never final; failure is never fatal. It’s courage that counts.”

13. Build in lots of margin, and never bet the farm. This means we keep plenty of liquidity and refrain from using long-term debt.

14. Live a healthy, sustainable lifestyle. Family, health and caring for others comes ahead of work.

15. Model hospitality daily. We love to host our team members, directors, business partners, mission partners, clients and friends.

16. Continually be on the lookout for new talent who will be a good fit. We believe in the Law of Magnetism. You attract who you are.

17. Nurture and add value to our strategic partners and clients. We are intentional about spending quality time with them, even if they live a thousand miles away.

18. Look for ways to be generous. We actively encourage generosity among our team members and strategic partners.

19. Model servant leadership. We put others first. Success is easy when no one cares who gets the credit.

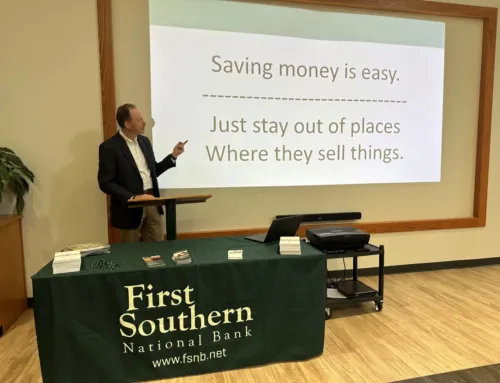

20. Stay true to our Core Values and Purpose. Our purpose is “to use our example, our influence, and our resources to help others make wise financial decisions.” This means, for example, that we encourage our borrowers not to get over-leveraged and to pay off debt quickly. And we actively counsel depositors to help them minimize overdraft fees.

Article originally hosted and shared with permission by The Christian Economic Forum, a global network of leaders who join together to collaborate and introduce strategic ideas to spread God’s economic principles and the goodness of Jesus Christ. This article was from a collection of White Papers compiled for the CEF’s 2019 Global Event attendees.