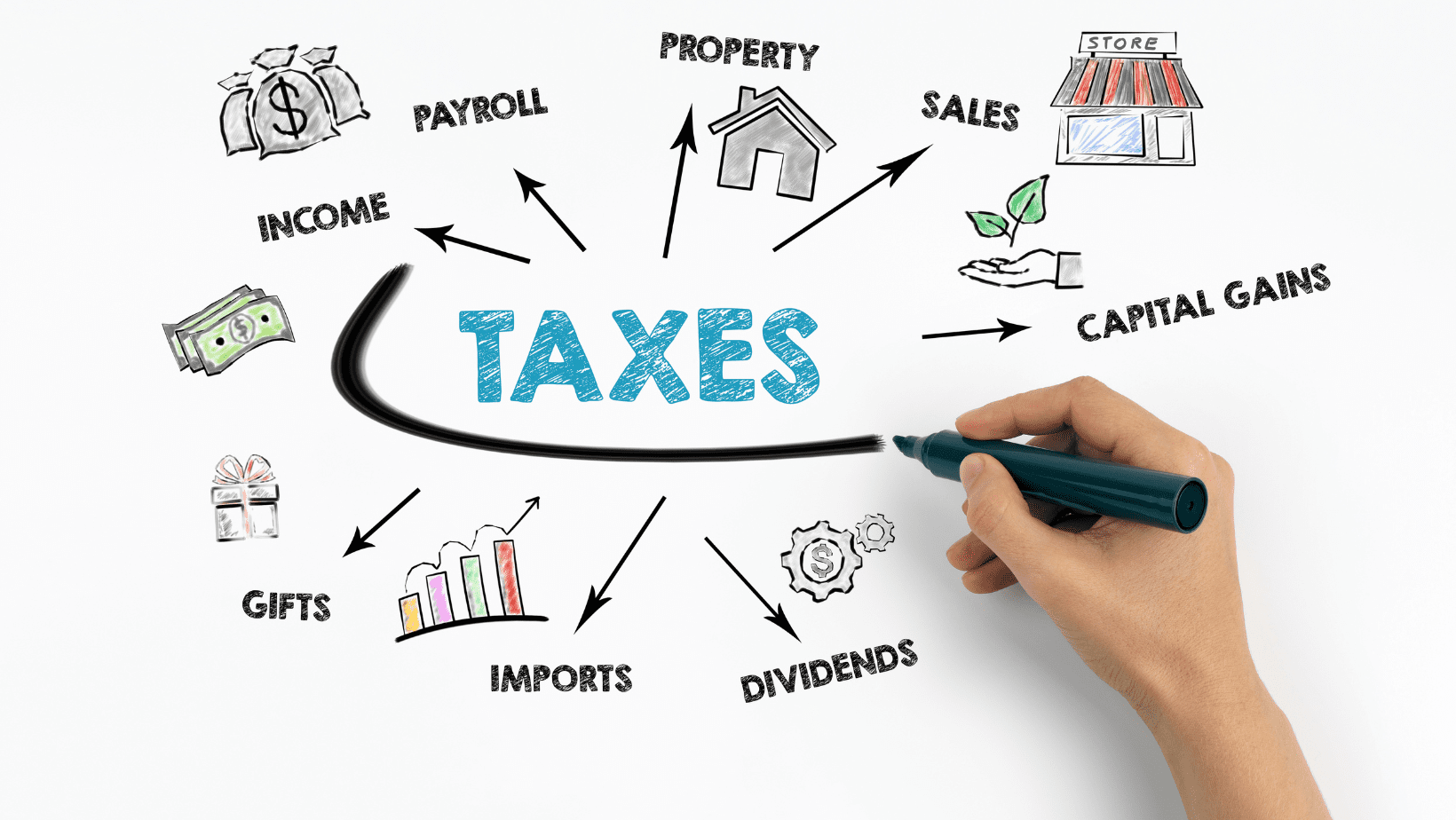

Adolescence is the perfect time to start teaching taxes—what they are, how they work, why we pay them, etc.

Taxes are filed differently based on income and lifestyle, making it difficult to explain all the intricacies that come with filing taxes. But students can still learn tax basics early so they’ll understand the concept as adults.

5 Activities That’ll Make Teaching Taxes Easy

Use these activities to help your students get a head start on their future taxes. With your help, they’ll be filling out W4s and filing taxes in no time.

Activity # 1: The Token Economy System

Similar to a traditional rewards system, the Token Economy System lets students earn tokens in exchange for good behavior, volunteer efforts, or even chores. These tokens are then used to purchase bigger rewards like a candy bar, a notebook, etc.

A system like this makes it very easy to include the concept of taxes. All you have to do is explain to the kids that for every 10 tokens they get, they have to give one token back as a sort of service fee or tax. You can then explain to each of them what this tax would be used for—each token helps pay for classroom supplies and improve the gifts they’re able to buy later on.

Activity # 2: Filling Out a W4

Do you remember your first job and how overwhelmed you felt when they handed you a form and asked you to fill it out? Just like how you felt, most teenagers aren’t sure how to fill out a W4. Here’s how to go about teaching this:

Step 1: Explain to your students what a W4 is—a form that employees need to fill out before starting their employment so that their employer knows how much federal income tax should be withheld from their pay.

Step 2: Download this Banzai W4 Worksheet that lets students practice filling out a W4 form without the need to include their own personal information.

Step 3: Have students experiment with this Federal Income Tax Withholdings Calculator by giving them a list of hypothetical incomes and filing scenarios so they get a good idea of how much tax is withheld.

What is the difference between a W4 and a W2?

A W4 is filled out by an employee at the beginning of a job so the employer knows how much tax they should withhold from the employee’s paycheck based on each employee’s filing status. A W2 is given by an employer to their employee at the end of every year to show how much that employee made and how much money was withheld from their paycheck for taxes.

Activity # 3: Save Your Receipts

A great way to demonstrate the idea of sales tax is by showing kids a sales receipt and how much tax was owed after checking out. Explain to your students that sales tax differs between states and is used to fund the local community budget for things like schools, criminal justice, fire department, health programs, etc.

Activity # 4: Practice Filling Out a Tax Form

The IRS has some great resources when it comes to how, when, where, and who should file taxes. On their website, the IRS has a series of forms that can be used to help students practice and understand how the tax filing process works. Here’s how to get them started:

Step 1: Print off the 1040 form—one of the official documents used to file taxes—and pass out the empty forms to your students.

Step 2: Explain to them the important sections of the form.

Step 3: Let them practice filling out the information.

Step 4: If you think it could be helpful, the IRS provides a 1040 fill-out instruction booklet to use when filling out the 1040 form.

Activity # 5: Calculating Tax Brackets

A great way for kids to understand tax brackets is by researching a career and calculating how that salary would be divided into the various tax brackets. Use the IRS website as a resource for them to see the marginal tax rates for the current year—you could also provide them with a printed chart.

Explain to students that tax brackets mean you pay a different tax rate for each portion of your salary. To help kids understand this concept:

Step 1: Ask them to draw 6 squares on a piece of paper and assign each of the six boxes a rate—35%, 32%, 24%, 22%, 12%, and 10%.

Step 2: Next, tell them to research a career that they’re interested in and write down the beginning salary.

Step 3: Then have them designate what amount of salary should be placed in which percentage box.

Example: Let’s take a US salary of $51,000. Here’s what $51,000 would look like when broken down into corresponding tax rates: $9,950 should be placed in the 10% box, meaning that amount of income will be taxed at that rate, $40,525 should be placed in the 12% tax bracket box, and the final $525 should go in the 22% tax bracket box.

While we hope you find this content useful, it is only intended to serve as a starting point. Your next step is to speak with a qualified, licensed professional who can provide advice tailored to your individual circumstances. Nothing in this article, nor in any associated resources, should be construed as financial or legal advice. Furthermore, while we have made good faith efforts to ensure that the information presented was correct as of the date the content was prepared, we are unable to guarantee that it remains accurate today.

Neither Banzai nor its sponsoring partners make any warranties or representations as to the accuracy, applicability, completeness, or suitability for any particular purpose of the information contained herein. Banzai and its sponsoring partners expressly disclaim any liability arising from the use or misuse of these materials and, by visiting this site, you agree to release Banzai and its sponsoring partners from any such liability. Do not rely upon the information provided in this content when making decisions regarding financial or legal matters without first consulting with a qualified, licensed professional.