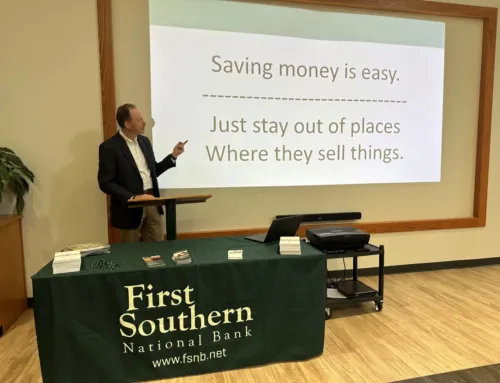

We get it. Saving money is hard. With small steps, you can make big changes towards your savings journey.

1. COMMIT TO ESTABLISHING EMERGENCY SAVINGS

Unexpected expenses and emergencies can sabotage your financial goals, so that is why it is crucial to build an emergency fund. Set a goal of saving $500 for a rainy day fund. Once you reach that goal, keep saving!

Remember, how much you need in your emergency fund is unique to you and your personal circumstances.

2. OPEN A SAVINGS ACCOUNT

If you don’t have a savings account, it is never too late to open one! Visit a local bank to open an account with low or no fees.

3. SET UP AUTOMATIC SAVINGS.

The easiest way to save is to save automatically! Contact your employer to set up a direct deposit into your savings account each pay period, or set up an automatic monthly transfer from your checking account to your savings account. FSNB also offers Round-Up Savings and Club Accounts to make saving easy.

4. GET SERIOUS ABOUT REDUCING YOUR DEBT

When you begin paying off your debt, you save on interest and fees while maintaining or improving your credit score. Create a debt reduction plan that works best for you and commit to it. Find out more about debt management.

5. GET CLEAR ON YOUR FINANCES

Create a spending and savings plan that allows you to easily see your income, expenses, and the amount leftover. Once you have a clear view of your finances, you can determine where you need to make changes and what else you should be saving for based on your financial goals.