The Paycheck Protection Program (PPP) was designed to help businesses with financial hardships due to the COVID-19 pandemic. We believe in our customers and their businesses, and we are thankful for the small part we could play in our communities by distributing PPP loans.

In total, were able to provide loans totaling $23,451,383.62! We assisted businesses of all sizes with loan amounts ranging from $320 to $1.02 million.

Roy’s Bar-B-Que and Russellville Dental Laboratory are just two of the 783 businesses that we guided through the PPP loan process.

Roy’s Bar-B-Que

Roy’s Bar-B-Que is a family-owned restaurant in Russellville, KY, with a 38 year legacy of good home cooking.

When the governor ordered restaurants to close indoor dining on March 18, 2020, Roy Morgan, son of the restaurant’s founder, began to doubt their future. “I thought we were going to go broke. I thought there was no way we were going to make it with the shutdown,” he said.

“I talked to Steve at the bank,” co-owner Lee Ann Harris said, “and I asked him if we needed a little help to get through until things got to looking better. He met us out here and led us through it and told us exactly what to do.”

Steve Stuart, an FSNB loan officer, was glad to help a business that’s so important to the community, and he praised their hard work. “They figured out how to keep their business alive and afloat,” Stuart said. “I’m sure like every restaurant in the area and country, they struggled with how to keep their doors open and their payroll going, keep people employed, and keeping serving the public. Roy’s figured it out.”

With ingenuity and help from the PPP loan, Roy’s Bar-B-Que kept the doors open and kept customers fed.

“They stuck with us, and we stayed busy,” co-owner Kathy Howard said of their customers.

“They stuck with us, and we stayed busy.”

Russellville Dental Laboratory

Russellville Dental Laboratory is a third-generation business that provides dentures, partials, crowns and bridges to dentists and dental clinicians across the United States.

“When COVID-19 first became an issue for us, it hit really fast,” said managing partner Lee Coursey. “Ultimately, with the help of First Southern and the Paycheck Protection Program, we were able to make sure our people were taken care of – that they were paid and that we were continuing to move forward as a company.”

Coursey understands the importance of a local bank, and First Southern was his first choice to turn to for help. “I grew up in this community, and I still live in this community,” he said. “I can tell you that walking into First Southern is like walking into your hometown. There’s a lot of local businesses, but very few greet you by your name, ask you how your kids are and know what’s going on in your life. That’s why I chose them as my bank.”

“There’s a lot of local businesses, but very few greet you by your name, ask you how your kids are and know what’s going on in your life. That’s why I chose them as my bank.”

These are just a few of the many stories our customers have shared with us.

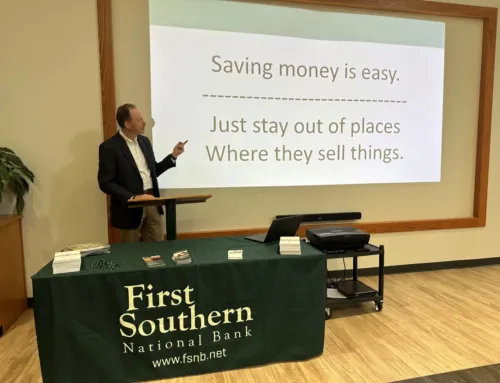

It has been an honor to support businesses during this challenging time. While the Paycheck Protection Program may be over, our team of lending experts would love to come alongside individuals and businesses to help you live out your dreams and goals or serve as a financial mentor.