WE HELP YOU FLOURISH WITH MARGIN

There is little doubt that many are facing financial hardships in our country today.

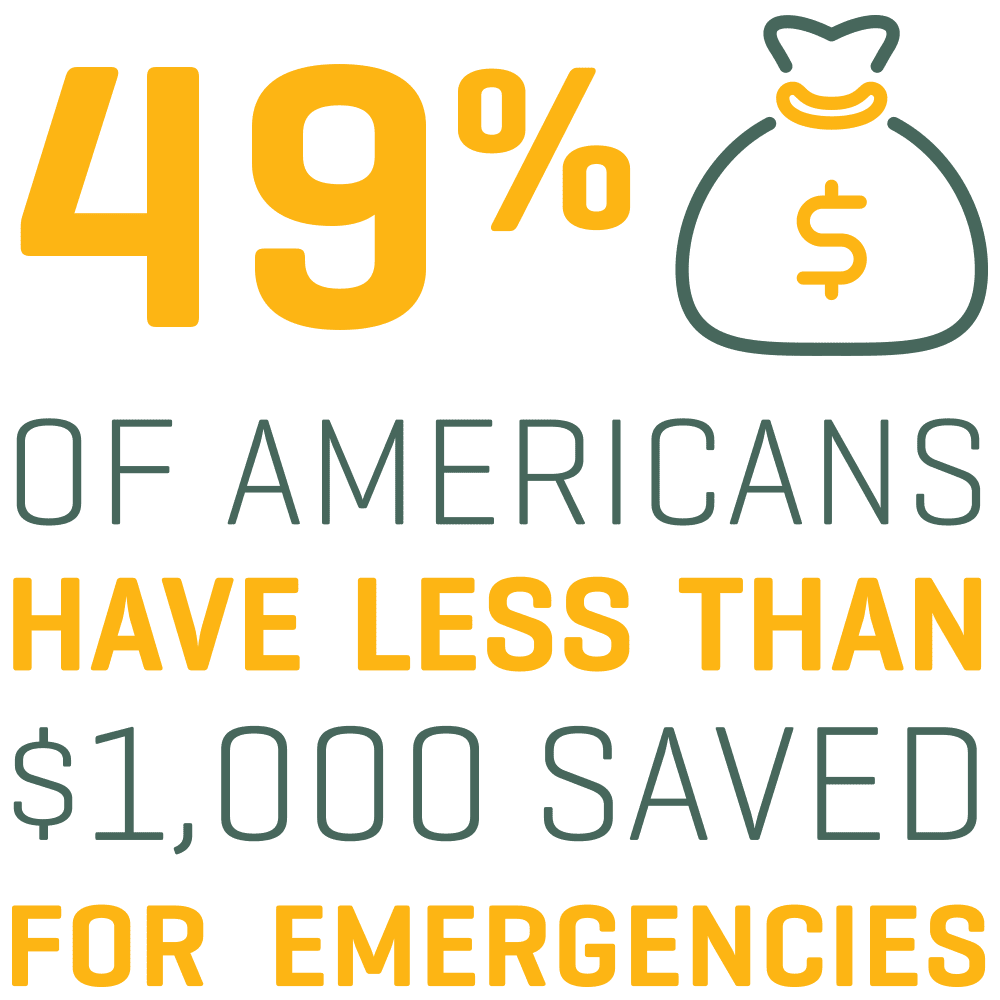

The statistics can be startling:

-

Only about half of Americans (49%) have $1,000 or more in savings, and one-third of Americans (34%) have no savings at all (SOURCE)

-

78% of Americans feel like they’re living paycheck to paycheck (SOURCE)

-

The majority of Americans have less than $50,000 saved for retirement, 36% having less than $10,000 and 24% having nothing saved at all (SOURCE)

-

Americans carried more than $1 Trillion in credit card debt in 2023 (SOURCE)

While it can be easy to point fingers and blame those who live in these circumstances, the truth of the matter is that many Americans lack the basic financial knowledge to avoid these pitfalls.

EDUCATION IS THE ANSWER

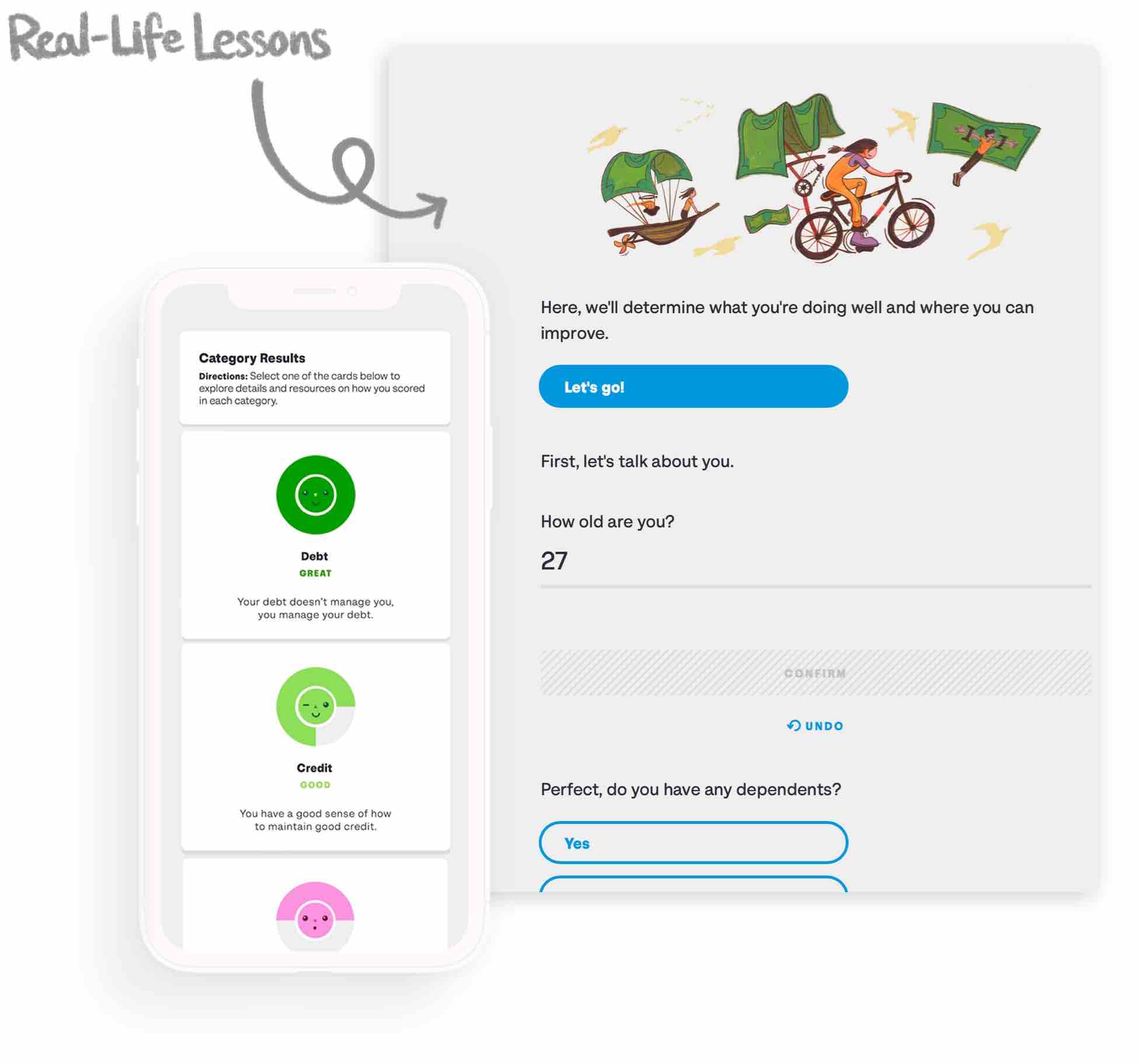

Our purpose is to use our example, our influence, and our resources to help others make wise financial decisions. To that end, First Southern has partnered with Banzai to provide the best in financial literacy materials, so that the people of our communities can be better equipped to face the financial challenges life throws their way. Please take time to browse the library below to learn more.

Financial Wellness Assessment

On a scale of 1 to 100, how do you think you’d score in a financial wellness assessment? Answer a few questions about your money habits, and discover areas where you’re succeeding financially, and ones that could use some work. You will receive a rating of your overall financial health and begin to design your path toward financial wellness.

This financial assessment evaluates the 8 most important aspects of your relationship with money.

Behaviors & Emotions

Consider how you feel about money and learn how to make your finances a source of fulfillment.

Savings

Evaluate your progress toward savings goals and learn what you can do to reach them faster.

Debt

List your debts and see how your payments affect your overall financial health.

Emergency Fund

Discover if you’re prepared to weather an emergency and how to create a safety net.

Spending Habits

Take a look at how you spend your money and discover how to improve your budgeting skills.

Borrowing & Credit

Examine your credit score and borrowing habits to find opportunities to improve.

Retirement

Find out if you’re on track to retire and what you can do to pick up the pace.

Insurance

Check for cracks in your coverage and prepare to protect your future.

BORROWING & CREDIT

How to Get Your First Credit Card

Wondering how to get your

Managing Credit

When people use credit, they purchase

Picking the Right Credit Card for You

Finding the right credit card

BUDGETING & SAVING

How to Save Money on Your Commute

Sometimes the ideal job comes

Learning to Budget With Us

A practical, workable budget is

Envelope Budgeting [Cash vs. Digital]

The traditional envelope budgeting system

HOUSING

Making a Down Payment on a House

A lot goes into buying

All About Escrow Accounts

When considering the obligations of

Working with a Mortgage Lender

To qualify for a mortgage loan,

RETIREMENT

Transitioning to Retirement

Transitioning to retirement takes planning

Understanding IRAs

Individual retirement accounts(IRAs) are personal

Social Security Basics

Social Security was established more

RUNNING A BUSINESS

Attracting Employees

By knowing what you’re looking

Health Benefits

Health insurance has changed dramatically

Keeping Your Employees

You’ve found an ambitious, hard-working

TAXES

How to Teach Income Tax: Lessons & Resources

Adolescence is the perfect time

Federal Income Taxes

Federal Income Taxes are a

Teaching Tax Basics

Looking for ways to teach

Insurance

5 Health Insurance Questions for 2024

Know all your choices before

Health Insurance Benefits

Between confusing terms, complicated processes,

Health Insurance Deductible Basics

When assessing which health plan

Life Changes

Changes to the 2024-2025 FAFSA Form

The government has rolled out

Out of Work

Losing a job can leave

Leaving a Job with a 401(K)

When you leave a job

Smart Living

Ransomware

Everyone has secrets—personal data, passwords,

Digital Spending Traps

Ever been playing a game

How to Increase Your Gas Mileage

No amount of wishful thinking

EDUCACIÓN FINANCIERA

Apertura de su primera cuenta

Abrir una cuenta en un

La regla de 72

Calcular los intereses compuestos es complicado.

Seguro para inquilinos

La política de un seguro